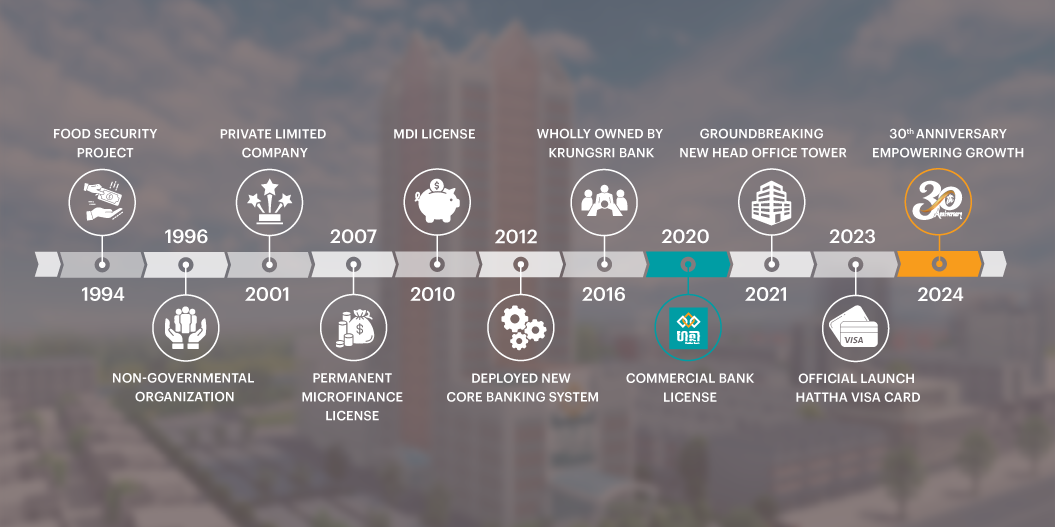

1994: Hattha Bank Plc. was starting from a food security

project established by OCSD/OXFAM–Quebec, a Canadian organization, providing

micro loans to rural people in four communes in Pursat province.

1996: The food security project was registered with the

Ministry of Interior of Cambodia as a nongovernmental organization (NGO) called

Hattha Kaksekar. In Khmer, “Hattha Kaksekar” means “Farmer’s Hand” or “A

Helping Hand for Farmers” with the head office in Pursat province.

2001: Hattha Kaksekar (HK) NGO was registered with the

Ministry of Commerce with paid-up capital of USD 77,850 to transform itself

into a private limited company with a new name, Hattha Kaksekar Limited (HKL).

At the same time, HKL was granted a three-year license by the National Bank of

Cambodia to operate microfinance services across Cambodia.

2007: The savings account and configured systems were

put in place. Meanwhile, HKL increased its registered capital from USD 257,850

to USD 1,339,700. Due to its sustainability in terms of finance, operation and

governance, HKL was offered a permanent microfinance license by the National

Bank of Cambodia.

2010: The National Bank of Cambodia offered HKL an MDI

“Micro-Finance Deposit Taking Institution” license due to the sustainability of

its operations and finances. This license reflects one of HKL’s successes in

providing customers with financial services, permitting HKL to officially

mobilize deposits from the public. Most noteworthy was the work done by the MIS

team to equip the sophisticated Core Banking System (CBS) enabling HKL to

deliver a prompt and efficient service in response to the company´s strategy to

transform itself into a commercial bank in the future.

2012: Hattha Kaksekar Limited’s new CBS successfully went

live across the company’s distribution networks. This new online system

increased the effectiveness of HKL’s business operations. HKL also invested

nearly USD 2 million in the ATM and mobile banking project. This investment

facilitates offering a wide range of financial services and serves customers

fast and conveniently through cash deposit and withdrawal machines that were

publicly launched by the end of 2012. Customers were able to perform many new

transactions including cash deposits, funds transfers, remittances, mobile

top-up, and currency exchange.

2016: HKL is a wholly-owned by Bank of Ayudhya

(Krungsri), the 5th largest bank in Thailand and a member of Mitsubishi UFJ

Financial Group (MUFG), Japan’s largest banking group and one of the world’s

largest and most diversified financial groups.

2020: Hattha Kaksekar Limited has transformed itself to

Hattha Bank Plc. which officially approved by the National Bank of Cambodia and

Ministry of commerce on 26th August 2020.

2021: Hattha Bank celebrated the groundbreaking ceremony

of its new head office tower with a totat construction area of more than 35,000

square meters with 22 floors, along Samdech Techo Hun Sen Street (Street 60

meters). The head office tower is responsible for the construction by CMED

Construction Co., Ltd., one of the leading construction companies in the

kingdom.

2023: Hattha Bank launched its Visa Card to provide its

customers with a new, seamless and global digital payment experience that is

characterized by ease, speed, convenience and security.

2024: Hattha Bank marks a significant milestone as it commemorates its 30th anniversary and this celebration serves as a tribute to the unwavering support and trust of Hattha Bank's esteemed customers and stakeholders.