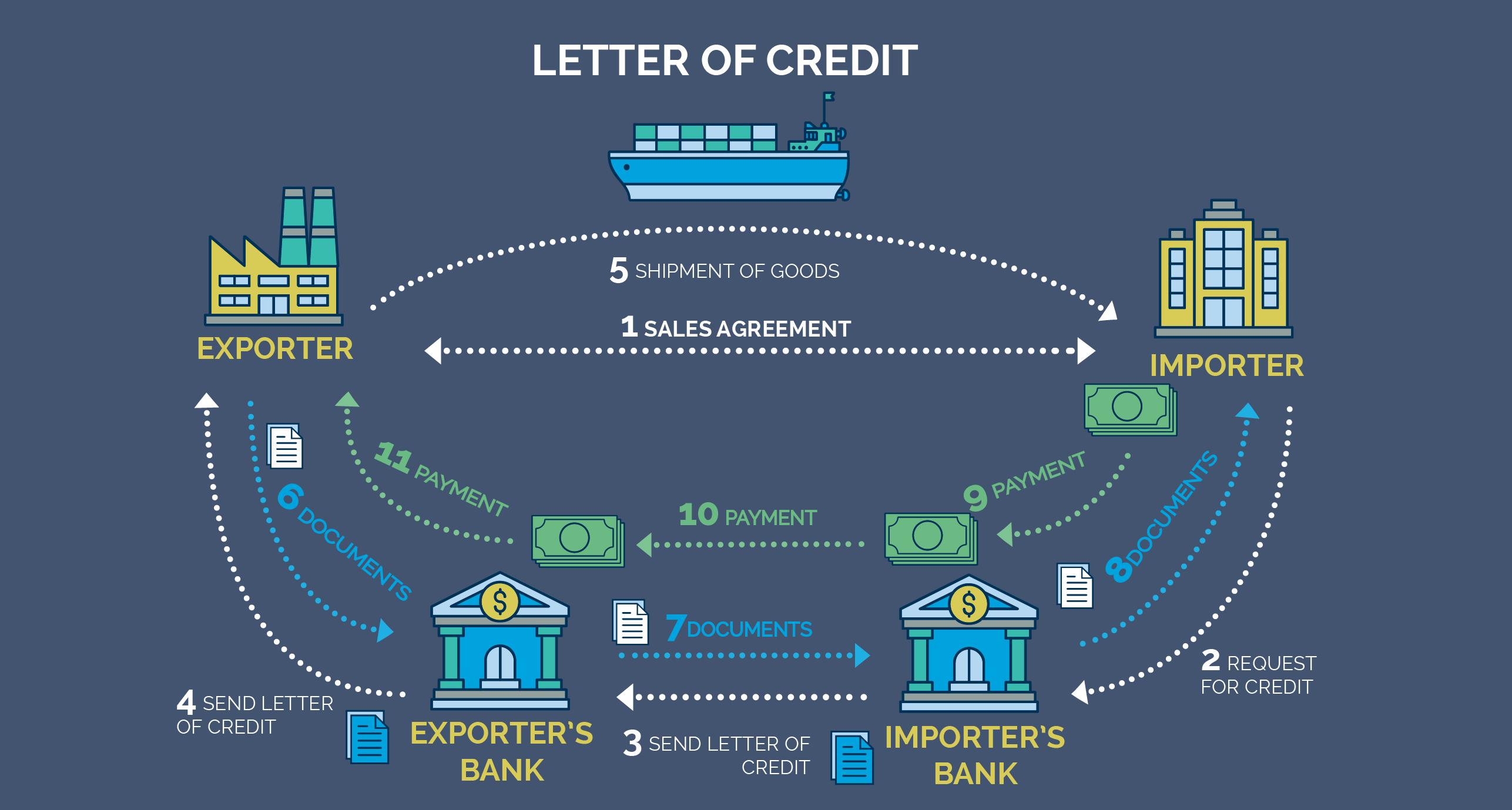

A letter of credit is a guarantee for the

payment of foreign goods issued by a bank. It is a document sent from a bank or

financial institution that guarantees that the seller will receive payment from

the buyer when the terms & condi[1]tions in the letter of

credit are fully and precisely met.

Three types of Letter of Credit are available

including Import Letter of Credit, Export Letter of Credit, and Shipping

Guarantee.

| Import Letter of Credit | |

|---|---|

| Currency |

KHR & USD |

| Tenor |

Up to 12 months |

| Collateral |

Cash Secured/Term

Deposit

|

|

Property (Credit Line)

|

|

| Transaction Amount |

No Limit |

| Issuing Fee |

Cash Secured/Term

Deposit: 1% p.a

|

|

Property (Credit Line):

1.5% p.a (Minimum USD 30.000)

|

|

| Amendment |

Wording: USD 30.00

|

|

Increase Amount/Tenor:

Same as Issuing Fee

|

|

| Cancelation |

USD 30.00 (After

transaction completed) |

| Settlement |

Settlement Fee: 0.15%

(Min USD 15.00)

|

|

Cable Fee: USD 15.00

|

|

|

Advising Payment Fee:

USD 20.00

|

|

|

Discrepancy Fee: USD

50.00

|

|

|

Reimbursement Fee: USD

50.00

|

|

| Shipping Guarantee

(Under LC) |

USD 50.00 |

| Export Letter Of Credit | |

| Advising Fee |

USD 50.00 |

| Settlement |

0.10% (Min USD 10.00) |

| Tracer/Inquires Fee |

USD 20.00 |

Note: Hattha Bank reserves the rights to change the above condition and interest rate without prior notice.